Information

Bids & RFPs

Budget Totals & Audit Information

County Employment Information

County Fire Departments Contact Information

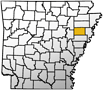

County Tax Rates

Courthouse Layout

Elected Officials

Election Information

Financial Disclosure Documents

Helpful Links

Ordinances/Resolutions 2023

Other Government Agencies

County Tax Rates

| REAL ESTATE and PERSONAL PROPERTY TAX RATES | |||||||||||||||

| Assessed in 2022 and Collected in 2023 | |||||||||||||||

| District 7 Vanndale School 39.9 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 49.4 |

|||||||||||||||

| District 7CV Cherry Valley School 39.9 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 4.5 Total 53.9 |

|||||||||||||||

| District 7HR Hickory Ridge School 39.9 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 3.8 Total 53.2 |

|||||||||||||||

|

District 9T |

|||||||||||||||

| District 9C Wynne School 35.0 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 5.0 Total 49.5 |

|||||||||||||||

| District 14C Parkin School 35.0 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 3.0 Total 47.5 |

|||||||||||||||

| District 37 Twist School 54.8 County General 5.0 Road 5.0 Library 3.0 Jail 1.5 City 3.0 Total 64.3 |

| COUNTY SALES TAX RATES |

||

| State of Arkansas 6.5000% Regular |

||

| Cross County 1.0000% Regular |

||

| County Jail Construction 0.8750% Special |

||

| County Jail Maintenance & Operation 0.1250% Special |

||

| Wynne City 1.0000% Special |

||

| County Hospital 1.0000% Special |