Assessor

Sherri Williams Assessor |

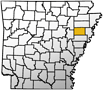

SHERRI WILLIAMS, ASSESSOR CROSS COUNTY ASSESSOR'S OFFICE 705 Union Ave E, Room 5 Wynne, AR 72396 Office: (870) 238-5715 FAX: (870) 238-5714 Email County Assessor Sherri Williams |

Welcome to the Assessor's office. Our goal is to equitably and accurately assess all real estate and personal property in Cross County in a professional and courteous manner that assures public confidence and funding for public services. As your Assessor, I will discharge my duties with fairness and integrity while upholding the laws of the State of Arkansas. This office strives to be a source of accurate and timely property information for local government, schools, and the community. Our office now offers all our real estate information free on-line at the link listed below. We also have the capability to e-mail your current personal property assessment.

OFFICE HOURS:

Monday thru Friday 8:00 A.M.-4:30 P.M.

Office does not close during the noon hour.

Closed for all federal holidays

DUTIES of the ASSESSOR

The duties of the Assessor are to appraise and assess all real property between the first Monday of January and July 1st, and all personal property between January 1st and May 31st (ACA 26-26-1408 and 26-26-1101). All property in the state shall be assessed according to its value on the first day of January except merchants and manufacturers inventory that is assessed at its average value during the year immediately proceeding the first day of January (AAC 26-26-1201).

All personal property and business personal property must be assessed between January 1st and May 31st. After May 31st, there is a 10% late assessment fee and penalties as required.

HOMESTEAD CREDIT

A homestead is a property that is used as one's principal place of residence and the person receiving the homestead credit is the owner of record or is buying on a recorded contract. A home owner who meets these requirements may be eligible for up to $425 credit on real estate taxes. To apply for a Homestead Credit, one must complete a form that can be obtained in the Assessor's office. Once the credit has been applied, the homeowner does not have to reapply, unless the person has purchased a new home or has moved. All homesteads must be applied for by October 10th of each year.

DISABLED OR 65 OR OLDER FREEZE

Anyone 65 years of age or older or 100% disabled may qualify for a freeze on real estate taxes. This freeze is placed on the real estate value that is the homestead. This does not include land that is priced as agriculture, such as timber or pastureland, or rental property. Anyone eligible for this freeze must come to the Assessor's office and fill out a form and provide the proper documentation verifying age or date of disability.

Real Estate is automatically assessed each year, unless one is adding a mobile home. If a mobile home is added, one must come to the Assessor's office and provide the specifics on that mobile home. Anyone who feels that the property value is not correct may file an appeal with the Cross County Equalization Board. The deadline to file an appeal is the third Monday in August of each year.

EQUALIZATION BOARD MEMBERS

Janet Beck

Anthony Blake

Terry Imboden

Robert Meyer

John Smith

Additional Information

Real Estate Inquiry-ActDataScout

Assess Personal Property Online

|

Deputy Assessor Unfilled at this time |

Phyllis Scarbrough Deputy Assessor |

Dina Milton |